lv financial report | louis vuitton results today

$145.00

In stock

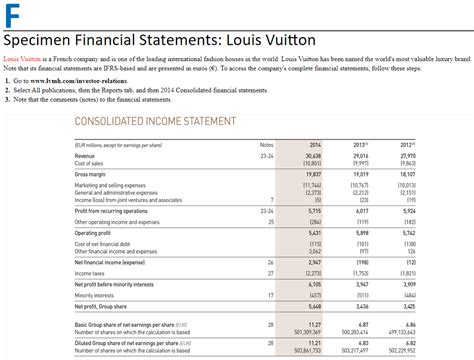

LV=, the UK-based investment, protection, and retirement specialist, has recently released its financial report, offering insights into its performance amidst a challenging economic landscape. While LV= operates in a different sector than luxury conglomerate LVMH, analyzing its report provides a valuable opportunity to understand the broader financial climate and compare and contrast performance across diverse industries. This article will delve into the key aspects of the LV= financial report, contextualizing it by referencing publicly available information and insights gleaned from analyses of LVMH's 2023 financial performance (using information available regarding *lvmh annual report 2023 pdf*, *lvmh financial statements 2023*, *sephora financial statements 2023* - to the extent publicly available, *louis vuitton results today*, *lvmh 2023 annual report*, *louis vuitton financial statements*, *lvmh balance sheet*, and information concerning *louis vuitton shareholders* where relevant).

Understanding the LV= Business Model and Operating Environment

Before diving into the specifics of the LV= financial report, it's crucial to understand the nature of its business. LV= operates in the financial services sector, offering a range of products and services aimed at helping individuals manage their finances across different life stages. These include:

* Investments: Products designed to help individuals grow their wealth over time, such as investment bonds and ISAs.

* Protection: Insurance products that provide financial security in the event of unexpected events, such as life insurance, critical illness cover, and income protection.

* Retirement: Pension plans and annuity products designed to provide income during retirement.

The performance of LV= is heavily influenced by factors such as:

* Interest rates: Changes in interest rates affect the returns on investments and the cost of borrowing, impacting both the demand for LV='s products and its profitability.

* Market volatility: Fluctuations in the stock market and other asset classes can impact the value of LV='s investments and the returns it can offer to its customers.

* Regulatory changes: New regulations in the financial services sector can impact the way LV= operates and the products it can offer.

* Economic conditions: Overall economic growth or recession can impact consumer confidence and the demand for financial products.

* Demographic trends: An aging population and changing attitudes towards retirement planning can influence the demand for retirement products.

Key Metrics to Analyze in the LV= Financial Report

When analyzing the LV= financial report, several key metrics should be considered:

* Revenue: Total income generated from the sale of products and services. This provides an indication of the overall demand for LV='s offerings.

* Profitability: Measures such as operating profit and net profit indicate how efficiently LV= is managing its expenses and generating profits.

* New business sales: The value of new policies sold during the reporting period. This provides an indication of the company's growth potential.

* Assets under management (AUM): The total value of assets that LV= manages on behalf of its customers. This is a key indicator of the company's scale and influence.

* Solvency ratio: A measure of LV='s ability to meet its financial obligations to its policyholders. A high solvency ratio indicates a strong financial position.

* Customer satisfaction: While not always explicitly reported in financial statements, customer satisfaction is crucial for long-term success. Look for indicators like Net Promoter Score (NPS) or customer retention rates.lv financial report

Comparing LV= to LVMH: Industry Context and Divergent Performance Drivers

While operating in vastly different sectors, comparing LV='s performance against the backdrop of LVMH's financial results offers valuable context. LVMH, the world's largest luxury conglomerate, operates in a sector driven by consumer discretionary spending, brand prestige, and global economic trends.

Here's a comparative framework:

* Revenue Growth: LVMH, particularly brands like Louis Vuitton and Sephora (although detailed *sephora financial statements 2023* are not generally publicly available), experienced significant revenue growth in recent years, driven by strong demand for luxury goods and experiences. LV='s revenue growth, in contrast, might be more modest and dependent on factors like interest rate fluctuations and investor confidence. In times of economic uncertainty, luxury goods might remain resilient due to their appeal to high-net-worth individuals, while financial services face headwinds. Analyzing *louis vuitton results today* (as publicly reported) can provide a benchmark for understanding consumer spending patterns at the high end of the market.

* Profitability: Both companies aim for high profitability, but the drivers differ. LVMH's profitability is often linked to brand strength, pricing power, and efficient supply chain management. LV='s profitability depends on factors like investment performance, expense management, and the pricing of insurance products. Higher interest rates can, paradoxically, benefit insurance companies by increasing investment returns on premiums held, but also negatively impact demand for certain products.

Additional information

| Dimensions | 9.7 × 2.2 × 1.6 in |

|---|