lv car | vegas auto gallery

$265.00

In stock

Owning a car is a significant investment and a key component of modern life, granting freedom and convenience. However, with that freedom comes responsibility, and one of the most crucial responsibilities is ensuring adequate car insurance. LV (Liverpool Victoria) car insurance stands out as a provider offering comprehensive coverage designed to protect you financially from the unexpected costs associated with accidents, theft, and damage. This article delves into the intricacies of LV car insurance, explores the broader automotive landscape, and provides valuable information to help you make informed decisions about your vehicle and its protection.

Understanding the Importance of Comprehensive Car Insurance

Before diving into the specifics of LV car insurance, it's essential to grasp the fundamental difference between comprehensive and third-party only insurance. While third-party only insurance covers damages you cause to other people's vehicles and property, it doesn't cover damage to your own car. This means that if you're involved in an accident that's your fault, or if your car is damaged by a falling tree or vandalism, you'll have to foot the entire repair bill yourself.

Comprehensive car insurance, on the other hand, provides a much broader scope of protection. With comprehensive car insurance, you're covered for damage to your own car as well as the others involved in a claim, so you're not left with the full cost of repairing or replacing your car. This includes:

* Accidental Damage: Covers damage resulting from collisions, regardless of who is at fault.

* Fire Damage: Protection against damage caused by fire.

* Theft and Vandalism: Covers the cost of repairing or replacing your car if it's stolen or vandalized.

* Natural Disasters: Protection against damage caused by natural events like floods, storms, and earthquakes.

* Third-Party Liability: Covers damages you cause to other people's vehicles and property, as well as legal costs.

* Uninsured Driver Protection: Provides coverage if you're hit by an uninsured driver.

The peace of mind offered by comprehensive insurance is invaluable, especially considering the potentially high costs of car repairs or replacement.

LV Car Insurance: A Deep Dive

LV (Liverpool Victoria) is a well-established and reputable insurance provider in the UK, known for its competitive rates, comprehensive coverage options, and commitment to customer service.

LV Car Insurance Website:

The LV car insurance website is a user-friendly platform that allows you to:

* Get a Quote: Obtain a personalized quote based on your specific circumstances, including your age, driving history, the type of car you drive, and your location.

* Review Policy Details: Access detailed information about the different types of coverage offered, including policy limits, exclusions, and optional extras.

* Manage Your Policy: Update your contact information, change your coverage options, make payments, and file claims online.

* Find Answers to Your Questions: The website features a comprehensive FAQ section that addresses common questions about car insurance.

LV Car Insurance Existing Customers:

LV provides dedicated support and resources for existing customers. This includes:

* Online Account Management: Easily manage your policy online through the LV website or mobile app.

* Dedicated Customer Service Team: Access to a team of trained professionals who can answer your questions and assist with your needs.

* 24/7 Claims Support: The ability to file a claim online or over the phone, 24 hours a day, 7 days a week.

* Renewal Options: Receive renewal notices and explore your options for renewing your policy.

What Sets LV Car Insurance Apart?

While numerous car insurance providers exist, LV distinguishes itself through several key features:

* Comprehensive Coverage: LV offers a range of comprehensive car insurance policies designed to meet diverse needs and budgets.lv car

* Competitive Rates: LV is known for offering competitive rates, particularly for drivers with clean driving records.

* Excellent Customer Service: LV consistently receives positive reviews for its customer service, with customers praising the company's responsiveness and helpfulness.

* Optional Extras: LV offers a variety of optional extras, such as breakdown cover, legal protection, and guaranteed courtesy car, allowing you to customize your policy to your specific needs.

* Multi-Car Discount: LV offers a discount for insuring multiple cars under the same policy.

Finding the Right LV Car Insurance Policy

Choosing the right car insurance policy requires careful consideration of your individual needs and circumstances. Here are some factors to consider when comparing LV car insurance policies:

* Coverage Limits: Determine the appropriate coverage limits for your needs. Higher coverage limits provide greater protection but also come with higher premiums.

* Excess: The excess is the amount you'll have to pay out of pocket in the event of a claim. A higher excess will typically result in a lower premium, but you'll have to pay more if you have an accident.

* Optional Extras: Consider whether you need any optional extras, such as breakdown cover or legal protection.

* Reviews and Ratings: Read reviews and ratings from other customers to get a sense of their experiences with LV car insurance.

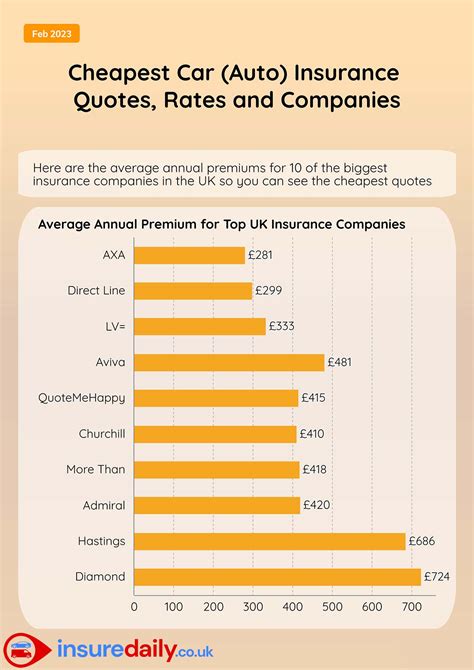

Top 10 Cheapest Car Insurance Companies UK (and How LV Compares)

While LV is known for competitive rates, it's always wise to compare quotes from multiple providers. The "top 10 cheapest car insurance companies UK" lists fluctuate depending on individual circumstances. However, some consistently competitive providers include:

1. Admiral

2. Direct Line

Additional information

| Dimensions | 9.3 × 1.3 × 3.5 in |

|---|